Insurance Portal Service

Intuitive, secure, customer-centric

Insurance customers today expect easy, digital access to services, advice and support. For insurers, this means creating modern customer experiences while simultaneously meeting regulatory requirements.

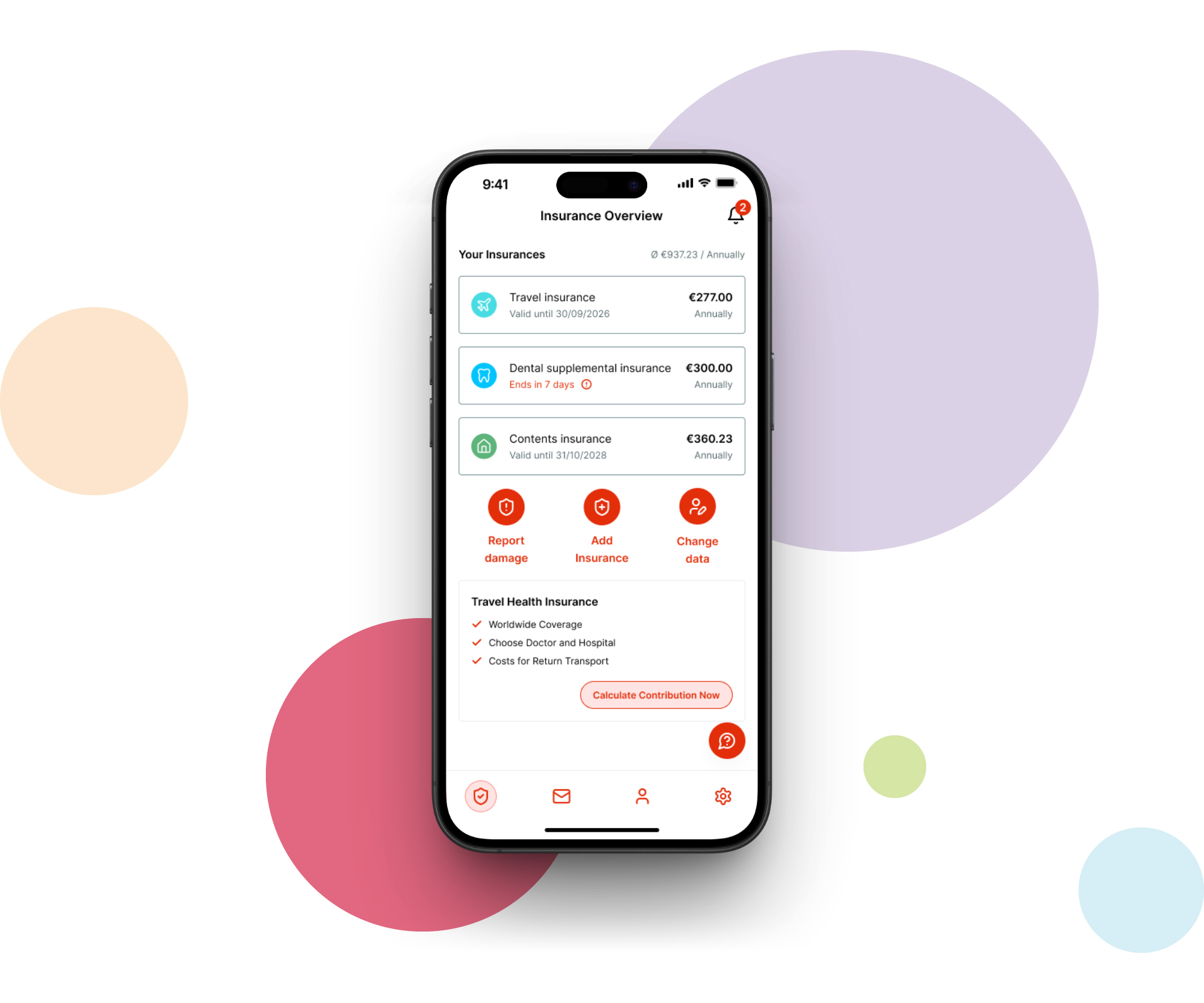

The Insurance Portal Service by Sopra Financial Technology fulfils both demands. Customers handle their insurance matters including claims reporting simply, intuitively and reliably. Our modular white‑label solution adapts to your brand, being user-friendly, secure and regulatory conform.

Trust begins digitallyIt is time to act now

Whether it’s requesting a quote or submitting a claim, customers want to resolve issues quickly. Insurers that fail to modernise lose time, trust and market share. A user‑centric, secure insurance portal sustainably strengthens customer loyalty.

Digital innovation drives the market

- Accessible Access: From June 2025, it will be legally required for digital banking services.

- Artificial Intelligence (AI): Personalized advice, automation, and intelligent document analysis.

- Cybersecurity and Zero Trust: Increasing demands on security concepts and zero-trust models.

- Intelligent Onboarding:Optimize your performance through intuitive and automated processes.

- Low-Code/No-Code Platforms: The platforms enable Fast, flexible portal development.

- Regulatory changes: ESG, DORA, etc. require continuous IT adaptations.

Strategically Modernized Digital Banking We turn challenges into advantages

Many small and medium-sized insurance companies face the challenge of meeting increasing market demands. Limited digital infrastructure makes it difficult to provide modern platforms and customer-centric apps. In addition, an often outdated software landscape hinders the full use of self-service portfolios in online portals. The integration of new technologies such as artificial intelligence is also difficult – both the necessary expertise and the appropriate IT infrastructure are often lacking. At the same time, the demand for customized, lean, and modular solutions that can be flexibly adapted to customer needs is growing.

Our contribution to digital success

We close the gaps – quickly and securely. With our solutions, insurance companies make the leap from outdated structures to a customer-centric, smart, and digital experience. Our intelligent, easily expandable portal solutions not only ensure personalization and efficiency, but also fast and consistent compliance. Thanks to Compliance by Design, your portals always remain up-to-date – secure, flexible, and future-proof. This allows you to exploit your full market potential.

As individual as your customersYour insurance platform for the future

As a core insurance system-independent provider, we offer a modular white-label SaaS platform that combines state-of-the-art AI with customized features, enabling a smart customer experience – cross-platform and barrier-free:

- Implementation against the existing core insurance system

- Responsive web frontend for desktop, tablet, and smartphone

- Accessible design according to WCAG Level AA

- Cloud-native SaaS operation with continuous development: low-maintenance, scalable, available

- AI-supported modules for self-service, product recommendations

- Compliance by Design: Seamless integration of regulatory requirements

Our Plug & Play SolutionFast implementation, modular expansion, and future-proof technology

Our SaaS cloud solution integrates seamlessly with existing core insurance systems, ensuring future-proof modernization. Standardization makes software adaptations easy and quick to implement, while continuous development within the SaaS model always meets the latest technological and regulatory requirements. Insurance companies thus benefit from a flexible, efficient, and fully compliant platform.

Your company. Your options. The diversity of our modules

-

Basics

Insurance overview, contract details and claim notification

-

KYC

Onboarding process for new and existing customers

-

Smart Ads

Contextual, targeted ads that offer real added value

-

Postbox

Digital delivery of documents and secure communication between insurance company and customer

-

Hybrid Consulting

Digital customer advice that enables the advisor to support customers safely and efficiently

-

-

-

Self-Service

Managing contract changes, tracking claim progress, etc.

-

-

AI Assistant

24/7 customer support, relief of the support department, implementation of automated processes

The difference in digital banking Excellent service for your customers

24/7 self-service and instant access

Your customers can manage their digital policies, submit claims online, and more. This reduces the workload for employees and saves costs.

Greater Accuracy

Digital data capture and automated workflows minimize manual errors and ensure that customer information is up-to-date and reliable.

Faster processing

Automated processes lead to shorter processing and waiting times – manual checks are no longer necessary.

More transparency and trust

Portals offer real-time updates on claims status and policy changes. This creates clarity and trust.

with IPS Focused into the future

Modern insurance business – flexible, AI-supported, and fully integrated

- White-label SaaS: tailored for financial institutions

- AI assistant with voice and dialogue control

- Automated lifecycle management for rapid innovations

- Backend-agnostic for every core insurance system integration

- Modular architecture with DDD concept (Domain Driven Design)

- Full accessibility, compliance integrated from the start

Our commitmentWe take responsibility for your digital evolution

Sopra Financial Technology has many years of experience in developing and operating software solutions for financial service providers. We combine technical expertise with deep industry knowledge. Our specialists from IT, insurance and regulatory disciplines ensure that your platform remains stable and secure—and grows with your requirements.

Contact usShape your digital insurance solution with us

Would you like to offer digital services that truly reach your policyholders? Tell us more about your individual requirements. Together, we will develop your digital platform—tailored, collaborative and future‑oriented.