Banking Portal Service

Your digital banking solution: intuitive, secure, customer-centric

Customers expect more than functionality. They want to handle their banking business easily, accessibly and reliably. Banks therefore face a dual task: they must position themselves clearly while responding to market changes.

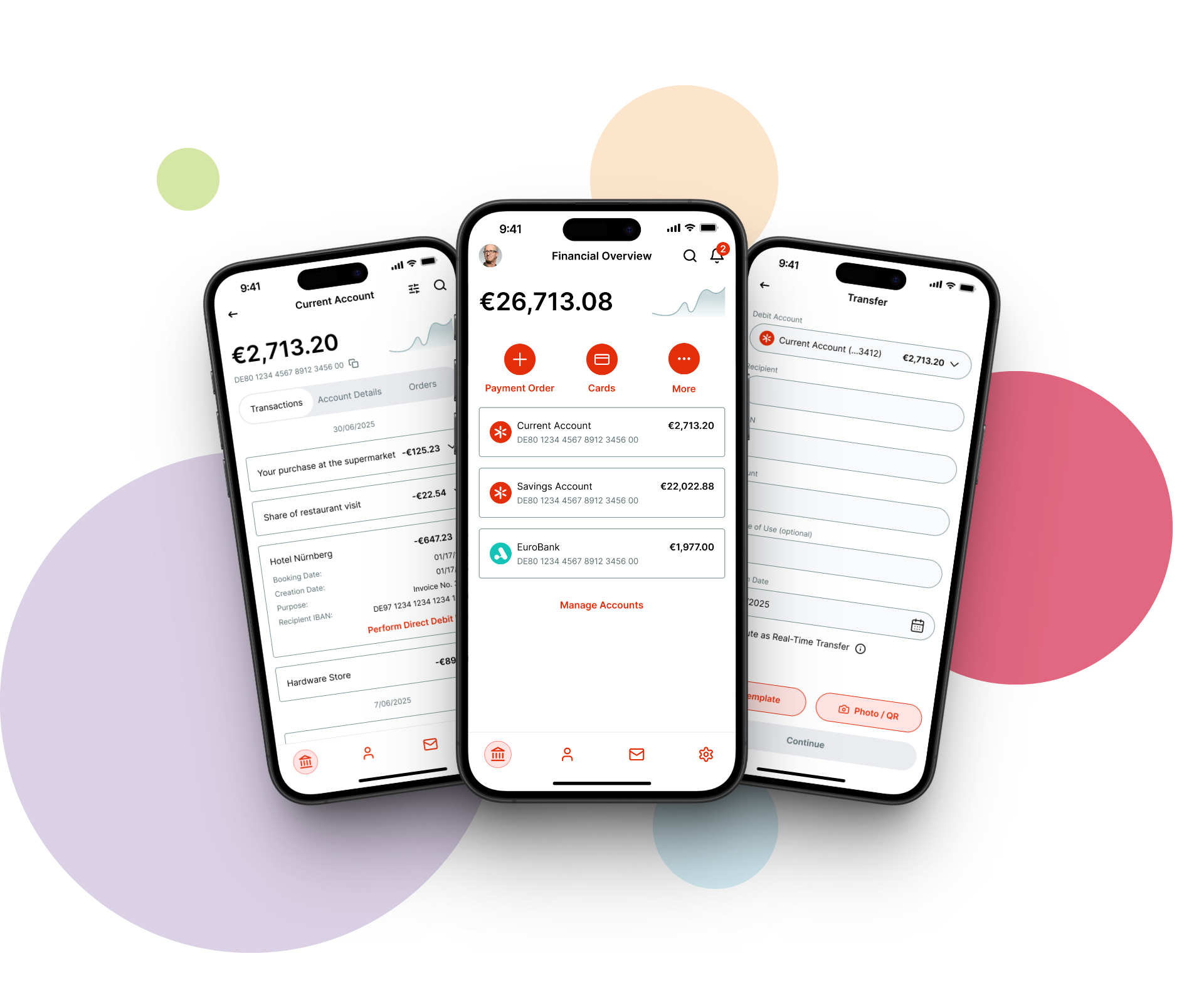

The Banking Portal Service from Sopra Financial Technology fulfils both requirements. Our modular white‑label solution adapts to your brand, scales with your needs and combines usability, security and regulatory compliance.

now is the right timeStart your digital transformation today

Customers expect fast and smooth solutions on every device. Regulatory authorities also require prompt and transparent information. Banks that fail to modernise lose time, trust and market share. Investing in a flexible, secure and user-centric online banking creates a strategic advantage.

Digital innovation is driving the market.

- Accessible access: From June 2025, it will be legally required for digital banking services.

- Artificial intelligence (AI): Personalized advice, automation, and intelligent document analysis.

- Cybersecurity and Zero Trust: Increasing demands on security concepts and zero-trust models.

- Intelligent onboarding: Optimize your performance with intuitive and automated processes.

- Low-code/no-code platforms: These platforms enable fast, flexible portal development.

- Regulatory changes: ESG, DORA, PSD2, GDPR, etc., require continuous IT adaptation.

Strategically modernized digital banking We turn challenges into advantages

Many small and medium-sized banks face the challenge of meeting increasing market demands. Limited digital infrastructure makes it difficult to provide modern platforms and customer-centric apps. In addition, an often outdated software landscape hinders the full use of self-service portfolios in online portals. The integration of new technologies such as artificial intelligence is also proving difficult – both the necessary expertise and the appropriate IT infrastructure are often lacking. At the same time, there is a growing demand for customized, lean, and modular solutions that can be flexibly adapted to customer needs.

Our contribution to digital success

We close the gaps – quickly and securely. With our solutions, banks make the leap from outdated structures to a customer-centric, smart, and digital experience. Our intelligent, easily expandable portal solutions not only ensure personalization and efficiency, but also fast and consistent compliance. Thanks to Compliance by Design, your portals always remain up-to-date – secure, flexible, and future-proof. This allows you to exploit your full market potential.

For your bank and your customersYour banking platform: modular, adaptable, ready to deploy

Our modular white‑label SaaS solution flexibly adapts to your requirements and ensures a consistent brand experience across all channels. It is accessible, cloud‑based and technologically state of the art:

- Implementation against the existing core banking system

- Responsive web frontend and native banking app for desktop, tablet and smartphone

- Individual adaptation to your corporate design for a consistent brand image

- Customisation to your corporate design for a consistent brand image

- Accessibility design according to WCAG Level AA

- Cloud‑native SaaS operation with continuous development: low maintenance, scalable, available

- AI‑powered modules for self‑service, product recommendations and financial overviews

- Compliant by design: Seamless integration of regulatory requirements

Your company. Your possibilities. The diversity of our modules

-

Basics

Account overview, transactions, payment orders – the core functions of digital banking.

-

KYC

Simple onboarding process for new customers – secure and compliant.

-

Hybrid Advisory

Personal consultation combined with digital efficiency – in real time.

-

-

Postbox

Digital delivery of documents and secure communication between bank and customer.

-

Smart Ads

Context-based offerings create added value for your customers and new revenue streams for your company.

-

PFM (Personal Finance Management)

Smart household budget book with visual representation of income and expenses.

-

AI Assistant

Automated support for routine tasks – secure, fast, and customized.

-

Open Banking

Integrate external accounts and process transactions via third-party providers.

-

Crypto & Securities

Overview and trading of securities and cryptocurrencies.

-

Self-Service

Your customers can independently manage address changes, cards, 2FA, account access and exceptions.

From integration to operationYour benefits at a glance

Fast Extensions & Faster Go-Live

Add new features and services at any time. Accelerate rollouts with standardized customizations – new features are available in no time.

Seamless Integration & Enhanced Intelligence

Rely on robust APIs and backend connectors for seamless integration with your core banking system. Leverage AI capabilities to increase efficiency and provide smarter customer service.

Individuality through a white-label solution

Realize your own ideas with hexagonal architecture, a cloud-native platform, responsive web and native mobile apps, and AI integration for banking processes.

Plug & Play for modern banking

BPS is ready to use immediately, modularly expandable, and developed to the highest standards.

Inclusive and Compliance Integrated

Meet BFSG / WCAG 2.1 AA standards, avoid fines, and achieve true accessibility. At the same time, regulatory requirements are met seamlessly and reliably.

The difference in digital banking Excellent service for your customers

24/7 self-service and instant access

Enabling your customers to manage their bank accounts around the clock and from any device.

More Innovation

The modularity of our solution allows you to always offer your customers the latest trends.

Faster processing

Automated processes lead to shorter processing and waiting times – manual checks are no longer necessary.

More transparency and trust

Portals provide real-time updates on account balances and transactions, reducing uncertainty and building trust.

Our commitmentWe take responsibility – for your digital evolution

For over 25 years, we have been developing and operating our own online banking systems. These figures speak for themselves:

- Over 5 million users,

- 1.5 million app downloads,

- 99.7 percent average service availability over the last 3 years,

- an average rating of 4.5 stars in app stores.

Our expert teams in IT, banking, and regulatory affairs, with years of experience in the financial sector, ensure that your solution functions flawlessly, remains secure, and scales with your needs. We combine technological excellence with in-depth industry knowledge to successfully implement your project. With our solution, you'll create an online banking experience that truly impresses your customers. We support you from the initial decision to stable operation – competently, proactively, and as a true partner.

Act nowTalk to us about your digital platform

You have the goal. We provide the right technology, the necessary understanding and the experience to make it a reality.